India Invoice Template

Create free India invoices online with VAT/GST

Create free India invoices online with VAT/GST

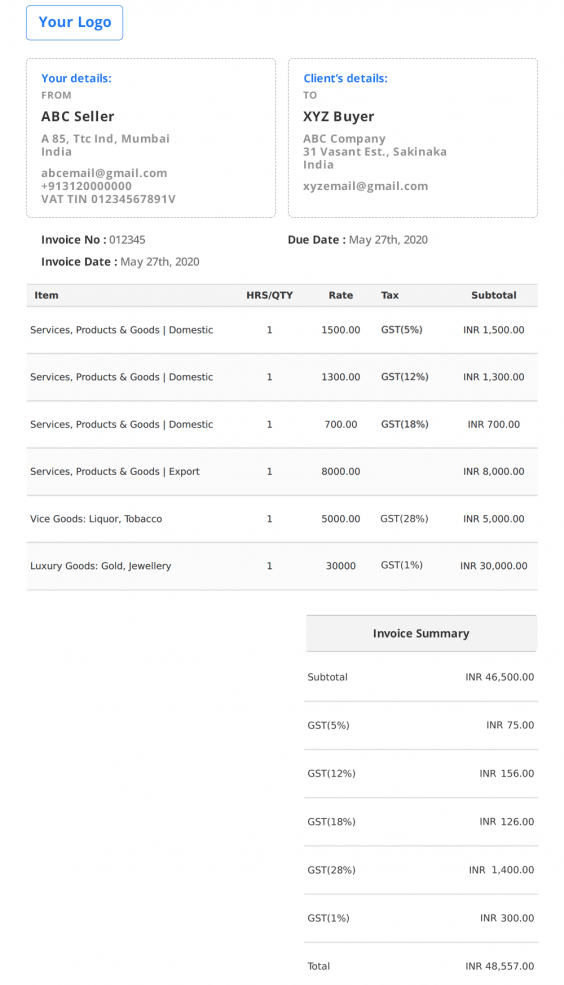

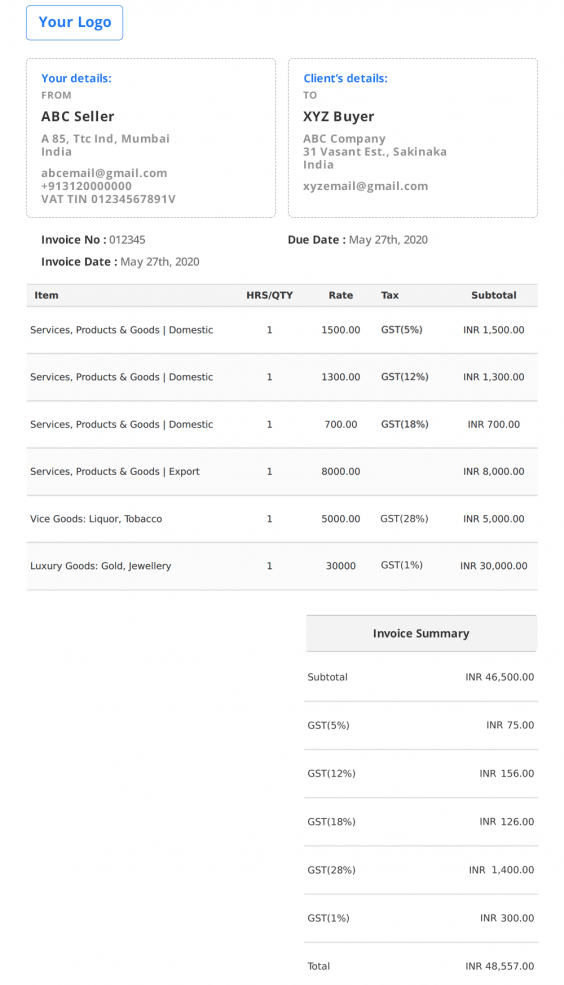

VAT is known as GST in India and is collected via electronic filing. With various rates and requirements, one way to simplify your VAT filing is to use invoice templates to create compliant invoices for all transactions. Build your VAT-compliant invoice for India today.

In India, all taxable sales and services must be accompanied by a compliant GST invoice containing a number of relevant details. These records can be electronic and should be retained for at least 6 years in case of an audit. The HSN code is a number recognized worldwide as corresponding to a unique product. The systematic classification of goods using uniform 6-digit codes is globally accepted and promotes ease of trade and commerce. Suppliers must maintain accurate records using GST compliant invoices.

| ✔ Date of invoice |

| ✔ Unique invoice number |

| ✔ Authorized digital signature |

| ✔ Customer personal details |

| ✔ Customer GST number |

| ✔ GST registration number (GSTIN) |

| ✔ State where goods are supplied |

| ✔ Details of any discounts |

| ✔ Total cost of supplies before GST |

| ✔ Details of taxable goods or services (including HSN)* |

| ✔ Details of applied GST rates (CGST, SGST, and IGST) |

| ✔ Supplier details (including business number, name, and address) |

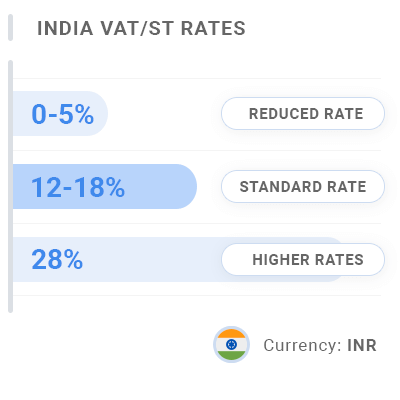

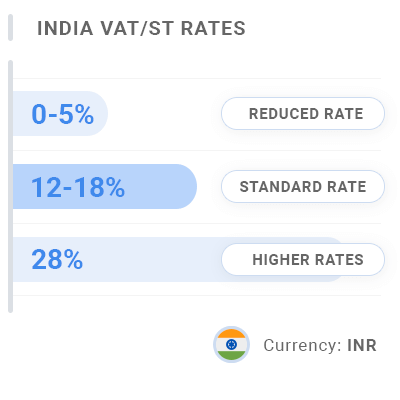

The enforcement of tax collection in India is by state and is structured to combine center or federal components and state-specific components. In India, these taxes are referred to as GST (Goods & Service Tax), with GST directed federally called CGST (Centre) and SGST (State). When goods or services are supplied across states, the GST collected will also include integrated GST (IGST) that is paid to the central government. IGST also applies to goods imported into India. The combination of these components is the GST, with the separate components paid out to the relevant authority. There are 29 Indian states, each with its own SGST, but the standard rate of state VAT will be between 12.5%-15%.

At the central level, the authority responsible for VAT/GST is the Central Board of Indirect Taxes & Customs (CBIC), a division of the federal department of revenue. Tax authorities at the state level vary.

| GST Rates | Goods/Services Included |

| NIL (0%) | Basic goods |

| 1% | Luxury goods: gold, jewellery |

| 4-5% | Daily consumption goods: oil, tea, coffee |

| 12%-15% | General: most consumer goods and services |

| Up to 28% | Vice goods: liquor, tobacco |

The GST implementation guidelines and rules vary from state to state. This means that GST registered businesses will typically file three separate GST returns in each state where they operate as well as an annual GST return.

There are a number of conditions where it is required for individual sellers and suppliers or businesses to register for VAT in India. The minimum annual turnover for VAT registration in India is Rs.5 lakh or $6,530. Any business with yearly revenue exceeding this amount and derived from the supply of goods or services liable for VAT must register in the state or states where their business is being conducted. When registering for VAT, businesses will receive a unique 11-digit registration number that will be used for all VAT-related communication and filing.

To register as a non-resident taxable person, you will be required to digitally sign and submit an application form directly to the relevant tax authority, along with a copy of a valid passport and a tax identification number from your country of origin. Once you have applied for VAT registration through the online Common Portal, you will receive an electronic reference number so that you can begin depositing and claiming VAT. All non-resident taxable persons must register for VAT/GST regardless of annual turnover at least five days prior to commencing business.

Depending on the turnover and type of goods or services supplied, VAT is filed on a monthly or quarterly basis.

| The following documents are required for VAT/GST registration in India: |

|

✔ PAN number ✔ Personal information ✔ Registered business name and address ✔ Security deposit or surety towards GST payment ✔Keeping inventory or maintaining warehouse in UK |

Indirect tax returns are filed by all businesses that have an annual turnover above Rs.5 lakhs and those without Indian residency and can be filed online. When filing, you will be required to include all relevant sales invoices and receipts of business-related purchases. These are the two components of VAT: input and output tax.

Output tax is VAT collected from the end customer by a supplier of taxable goods or services. All registered suppliers are required to charge tax on sales.

Input tax is any taxes paid by the supplier on business-related purchases and expenses. Registering for VAT/GST lets suppliers claim back taxes on such expenses in the form of input tax credits. If you have paid more VAT/GST on operational costs than you have collected from the supply of taxable goods or services, you will be able to reclaim the difference.

In order to supply accurate tax details to the relevant authorities, all tax liable and registered persons or entities must provide GST-compliant invoices. To make it more likely that you will be able to reclaim VAT/GST when you file, it is also recommended to retain all receipts for business-related expenses.

FreeInvoiceBuilder includes a range of customizable templates, including invoices with adjustable Tax(VAT) rates and currencies. It also includes invoice templates for specific industries and services like freelancing, social media, travel & tourism, web development, app development, IT services, marketing, content writing, training & tutoring, video production, web design, & much more. Our free tool is ideal for international merchants, freelancers, service providers, business owners, and independent contractors. Just customize the free printable templates and download your copy in PDF format. You can also generate other commercial documents like a receipt, quotation, estimate, purchase order, commercial invoice, & proforma invoice.

FAQs |

| Will my clients see “FreeInvoiceBuilder” on the Indian VAT/No VAT invoice? |

| Never, although our invoice generator is entirely free of cost, the generated Indian invoices are completely unbranded. |

| Can I add my logo to personalize the India GST invoice template? |

| You can easily drag or select your logo to the top left corner of the Indian GST invoice template and brand your business seamlessly. |

| Can I choose between different currency options? |

| Yes, FreeInvoiceBuilder provides you the option to choose any currency you trade in to create the Indian GST invoice with an accurate price. |

| Can I make a PDF Indian GST invoice? |

| Yes, even if you don’t have a registered account, our invoice generator offers a customizable ready-made invoice template to create & instantly download the PDF copy of your Indian GST invoice or save the information to use later. |

| How do I send an Indian GST/VAT invoice? |

| Send the created PDF Indian GST/VAT invoice electronically or print it. You can also share the link to your invoice so your client can download or print the invoice directly. |

| Do I need to register or make an account to create an invoice? |

| No, you don’t need to register or make an account to create an invoice however with an account you can save the invoices & information in the app for later use. |